Business

Access Bank assures shareholders of higher returns

Published

5 years agoon

By

Admin

Access Bank Plc at the weekend assured its shareholders of improving performance and returns as it continues to implement its pan-African expansion programme.

At the Annual General Meeting (AGM) in Lagos, which was also streamed real time online, directors of the bank assured that it has been well-positioned for sustained growth and better returns, and shareholders will continue to see higher dividends in the years ahead.

The assurance came as shareholders approved payment of a final dividend of 55 kobo, in addition to an interim dividend of 25 kobo, bringing total dividend per share for the 2020 business year to 80 kobo. In the audited report and accounts for the year ended December 31, 2020, Access Bank had grown net profit by 13 per cent to N106 billion in 2020 as against N94 billion recorded in 2019.

The assurance also came on the heels of the release of the first quarter results of the bank for the period ended March 31, 2021, showing considerable growths across all key performance indicators.

Key extracts of the first quarter report for the period ended March 31, 2021 showed that Access Bank grew its top-line to N222.1 billion in first quarter 2021 as against N209.8 billion recorded in comparable period of 2020. Net interest income had risen by 30 per cent from N72.12 billion in first quarter 2020 to N93.96 billion in first quarter 2021. Non-interest income also inched up from N77.93 billion to N78.34 billion. Profit before tax rose by 30 per cent from N46.2 billion to N60.1 billion while profit after tax increased from N40.9 billion to N52.6 billion.

The balance sheet of the group remained strong with total assets rising from N8.68 trillion in December 2020 to NN9.05 trillion in March 2021. Net loans and advances totaled also improved from N3.61 trillion in December 2020 to N3.64 trillion in March 2021. The bank continued to improve its credit risk management with the proportion of non-performing loans dropping from 4.3 per cent in December 2020 to 4.0 per cent in March 2021.

The report further showed that the group retail banking business recorded steady growth with a 112 per cent increase in revenue to N57.5 billion in first quarter 20121 as against N27.1 billion in first quarter 2020. There were 941,631 new customers signed-on through the bank’s financial inclusion drive during the quarter. The improvement was also evidenced by the consistent and robust savings account growth to N1.36 trillion within the three-month period, which led to a significant reduction in cost of funds.

With the increased adoption of its digital channels and the growing customer base, the bank recorded a 29 per cent growth in USSD Transaction value and 40 per cent increase in mobile and internet banking transaction value.

Addressing shareholders at the meeting, Chief Executive Officer, Access Bank Plc, Mr. Herbert Wigwe, said with the position of the bank in the financial services industry, it has been well-positioned to achieve significant growth in profitability and pay higher dividend over the years.

He outlined that the bank healthy capital adequacy ratio, a robust balance sheet and strong brand that would lead to a better performance in the years ahead.

According to him, Access Bank is best positioned to maximize the identified opportunities in Africa on the back of a growing customer base and the move to a cashless economy.

“We have identified Africa to be a vast pool of opportunities with over 370 million unbanked adults, $9.2 billion in remittances and cross border payments, 89 cities of over 1.3 billion inhabitants by 2025 and the overall African financial ecosystem. We also see opportunities coming from the new African Continental Free Trade Area (AfCFTA), as it is expected to expand intra-Africa trade to 53 per cent by 2022, eliminate tariff on qualifying trade and increase financial flows,” Wigwe said.

He added that Nigeria also presents several opportunities due to its large population, huge payments and remittance flows, and an emerging insurance market.

He pointed out that in order to capture emerging and existing opportunities, Access Bank will transit into a holding company structure that will enable it tap into the market opportunities that are available in the regulated banking and consumer lending market, electronic payments industry and retail insurance market.

According to him, through the restructuring, the bank will create new product revenues without taking incremental risks for the enterprise, ensure diversification of earnings, and support outside of Africa.

Wigwe explained that the series of mergers and acquisition the bank had undertaken since 2005 have all been value accretive, pointing out that the bank had commenced green field operations in Mozambique and completed the acquisition of Transnational Bank and Cavmont Bank in Kenya and Zambia to strengthen and increase their market presence.

“In early 2021, we received regulatory approval for our proposed acquisition of Grobank in South Africa to give us an inroad into the largest economic block in Africa and one of Africa’s biggest markets. Our acquisition of Grobank will help strengthen our foothold in the Southern African market- Africa’s largest economic hub and place us in a strong position to take advantage of Africa,” Wigwe said.

Reacting to the first quarter results, Wigwe said the strong results in a challenging macroeconomic and regulatory environment underscored the strong capacity of the bank’s business to generate sustainable earnings on the strength of its balance sheet, diverse revenue streams and dedicated people.

He noted that the bank continued to maintain robust capital and liquidity positions, well above regulatory levels with a Capital Adequacy Ratio of 22.2 per cent and a liquidity ratio of 48.3 per cent, which position the bank to support its customers across various markets and adequately execute its expansion strategy.

He reiterated that in furtherance of the bank’s vision to be the world’s most respected African bank and Africa’s payment gateway, the bank remains committed to a disciplined and thoughtful expansion strategy.

“Looking at the quarters ahead, we are poised for strong earnings growth fueled by our retail momentum, robust balance sheet, and operational efficiency,” Wigwe said.

Chairman, Access Bank Plc, Dr. Ajoritsedere Awosika, told shareholders at the meeting that in 2020, the bank made several investments to strengthen relationships with its customers.

According to her, by redefining its approach to customer service through streamlining of internal processes, and digitizing of about 30 per cent of customer journeys, the bank was able to improve on its customer experience while it was also able to manage its expenses in line with the target for 2020 despite double-digit inflation and overall cost of running the enlarged enterprise.

“As a result, we achieved a cost-to-income ratio (CIR) of 63.4 per cent from 66.1 per cent in 2019.We worked hard to recover and dispose of a significant portion of our non-performing assets. With a decline in the portfolio of overdue loans, our asset quality improved across our retail and wholesale segments. Our capital and liquidity ratios were also well above regulatory limits with our capital adequacy ratio remaining strong at 20.6 per cent,” Awosika said.

She said Access Bank would grow its businesses and continue to invest in information technology capacity until it becomes an incredibly strong bank for retail and wholesale customers around the world.

“As we continue to consolidate the gains from our decisive approach to pushing our retail franchise, we have identified several opportunities within Africa and beyond, for Access Bank to deepen its financial services offerings to banked customers as well as extend financial services to the unbanked,” Awosika said.

Shareholders at the meeting commended the board and management for their efficient running of the bank.

Chairman, Ibadan Zone Shareholders Association (IBZA), Mr. Eric Akinduro commended the bank for riding through the COVID-19 pandemic and delivering improved results that led to the declaration of 80 kobo dividend.

He said the various acquisitions by Access Bank across Africa showed that the institution is strong, assuring the bank of shareholders’ supports.

Founder, Independent Shareholders Association of Nigeria (ISAN), Sir Sunny Nwosu, said Access Bank’s expansion drive shows that the bank is really committed to its aim of playing a leading role in the African continent.

He expressed optimism that the expansion drive would lead to better returns to shareholders and other stakeholders in the years ahead.

You may like

-

Obanikoro Accuses Access Bank of Using His Property as Collateral for N1bn Loan without His Consent

-

Court Orders Arrest of Access Bank MD Over Allegation of Theft of Property belonging to Obanikoro’s Son

-

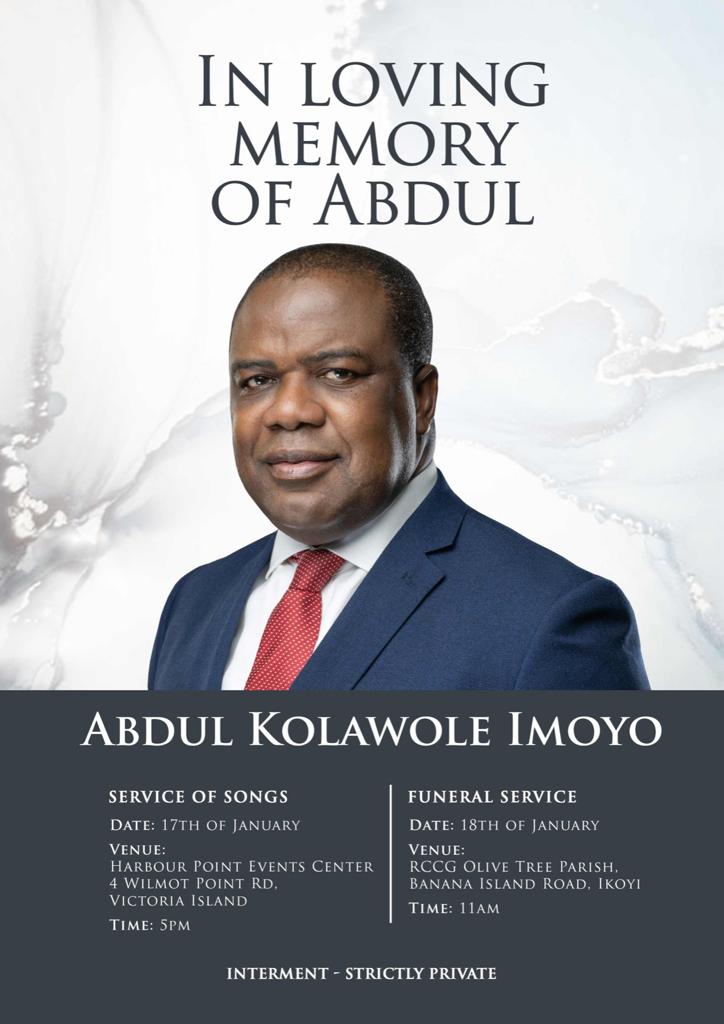

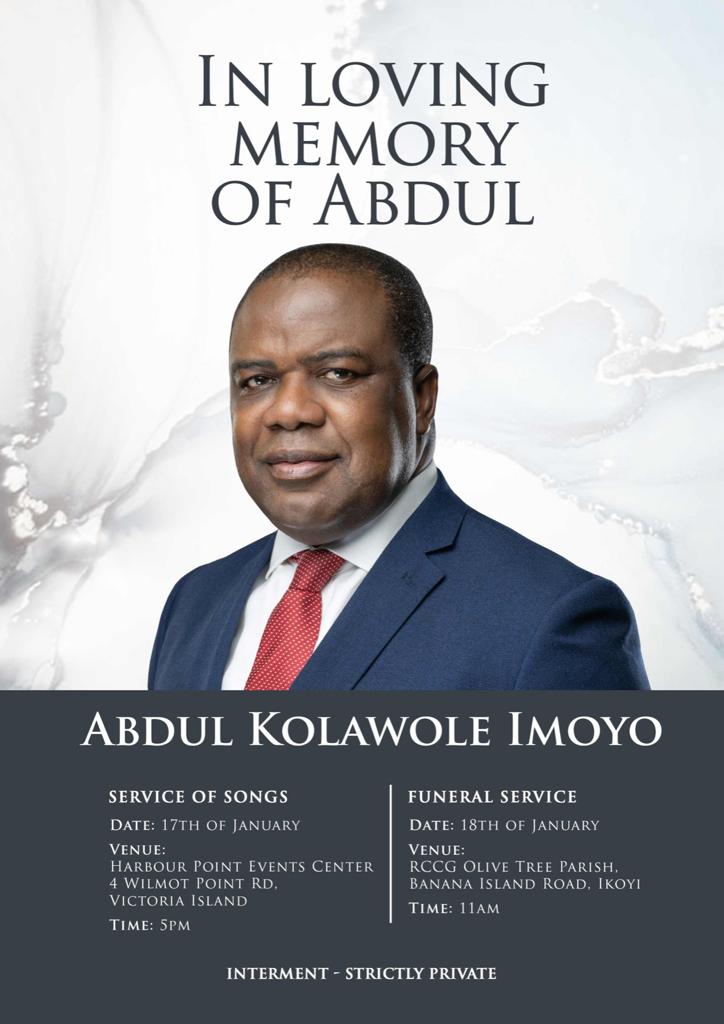

Final Farewell: ACAMB Announces Burial Arrangements for Abdul Imoyo

-

Access Bank to Acquire Kenya’s Sidian Bank for N15 Billion

-

Access Bank unveils smartphone Device Finance Scheme